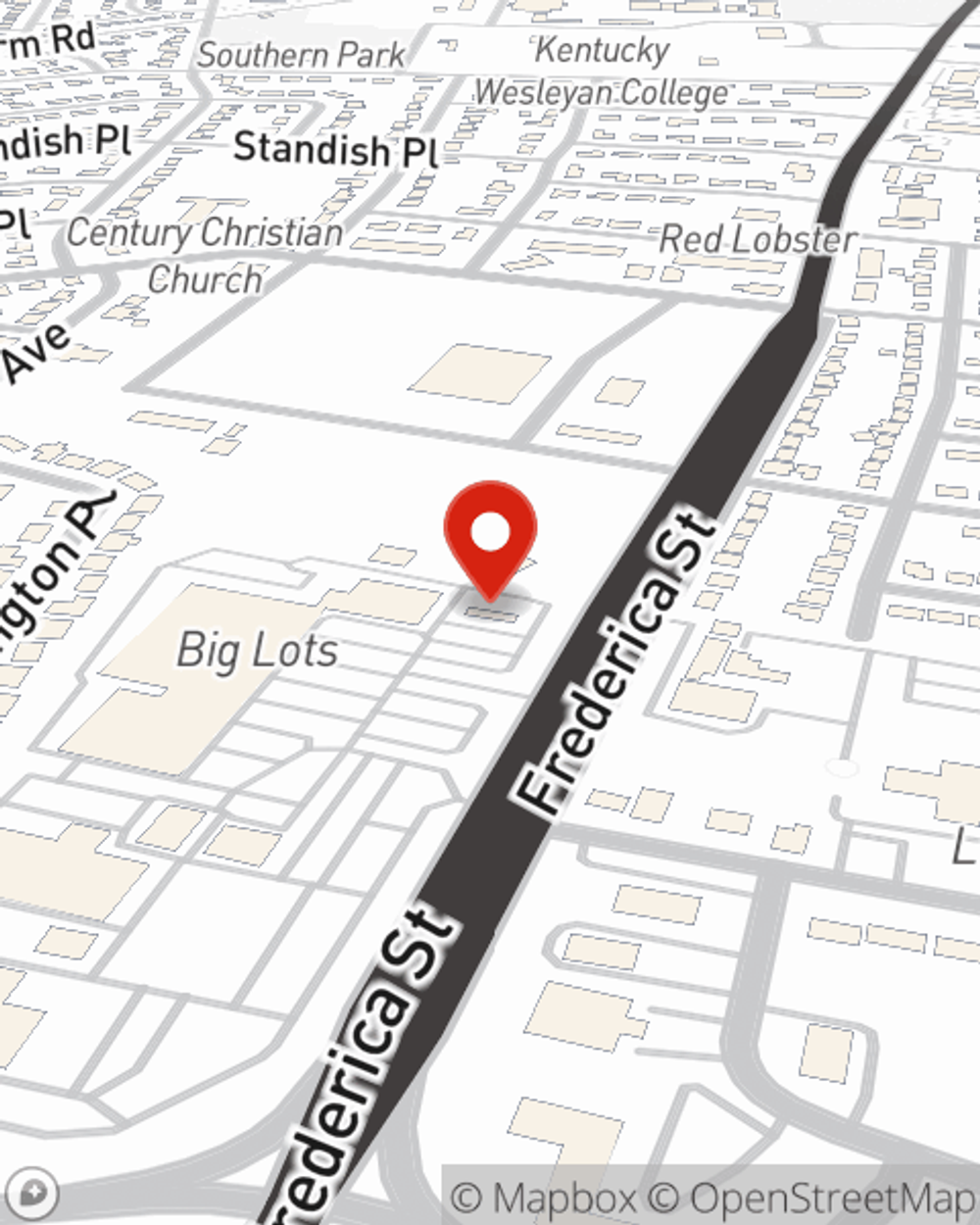

Business Insurance in and around Owensboro

One of Owensboro’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insure The Business You've Built.

Do you own an architect business, a camping store or a florist? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

One of Owensboro’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insurance Designed For Small Business

Your small business is unique and faces specific challenges. Whether you are growing a meat or seafood market or a shoe store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Drew Cunningham can help with extra liability coverage as well as key employee insurance.

As a small business owner as well, agent Drew Cunningham understands that there is a lot on your plate. Reach out to Drew Cunningham today to learn about your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Drew Cunningham

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.